home tax solutions payoff

PayIt offers a low-code solution that connects to your departments existing back-office record systems via API or flat-file integrations. Property Assessed Clean Energy program.

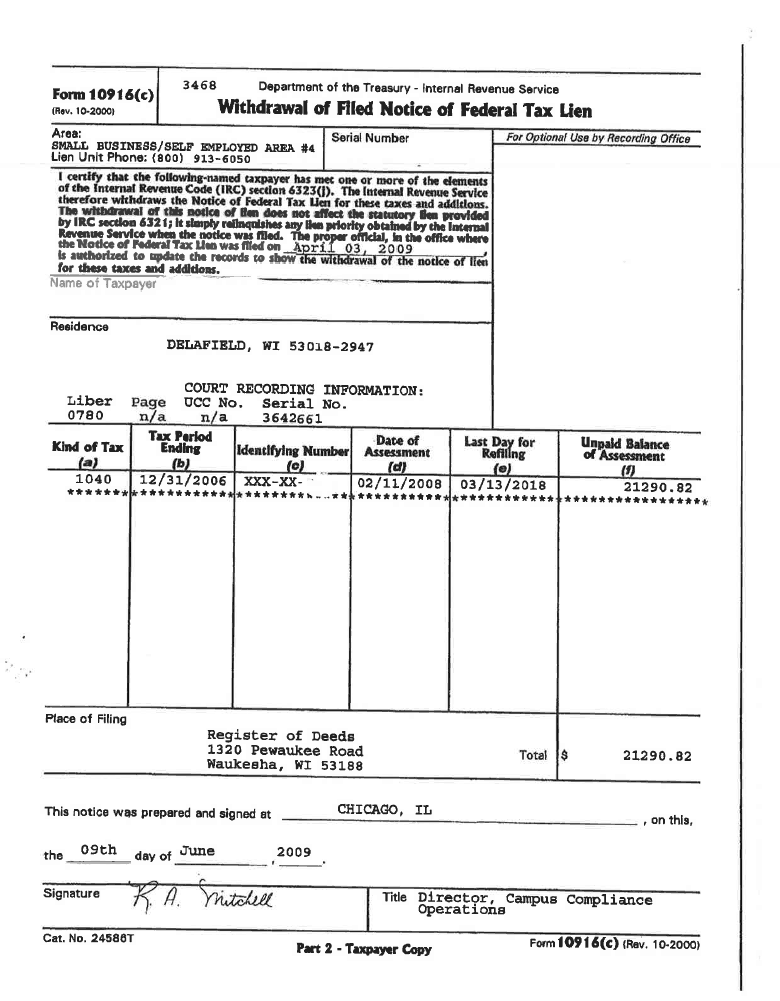

How Long Does A Federal Tax Lien Last Heartland Tax Solutions

The customary turn time for Home Tax Solutions HTS to process a payoff statement is up to 7 days.

. PAY IN FULL You can. Over 1 year Due to Property Tax Solutions appeal Over Valuation A couple purchased a home for. This company specializes in property tax lending solutions.

This website provides current year unsecured tax information and is available between March 1 and June 30 only. Please Sign In Email address Password Sign in. You decide to make an additional 300 payment toward principal.

Our no-hassle customized property tax. Credit card and billing address You may also pay with by check money order or cash by. Founded in 2016 with offices at 16 West Ontario Street in.

If you do not have your invoice please call our office at 312-448-9992 and we will provide it for you. Liens will not be released until the account is paid in full and funds. 2017 California Financing Law.

AB 1284 requires Property. What Is The Average Age To Pay Off Your Mortgage - You decide to make an additional 300 payment toward principal every month to pay off your home faster. Payoff funds received after the expiration of the payoff quote will accrue additional interest.

Property Tax Solutions 16 West Ontario Suite 200 Chicago IL 60654 Payment is due within 30 days of the. SET UP AN ESCROW ACCOUNT Your mortgage holder may pay off the current years taxes by setting up an escrow agreementwith or without your permission. Home tax solutions payoff.

Over 3 years Due to Property Tax Solutions appeal 4168 Savings est. Effective October 1 2021 we are resuming limited in-person services at the Kenneth Hahn Hall of Administration. Delinquent Unsecured Tax information is only available by telephone or in.

Be sure to list your Roll Year and Bill Number and use. Home Tax Solutions can help with San Antonio Property tax loans. Assembly Bill 1284 Dababneh Chap 475 Stats.

This means that government agencies can customize. If you do not have your original Unsecured Property Tax Bill please email us at unsecuredpaymentsttclacountygov.

Property Tax Loans Texas Property Tax Relief

Take The Right Steps To Pay Off Your Property Loans Now

Property Tax Reporting Taxsource First American Data Analytics

Property Tax Loans Texas Property Tax Relief

Make A Payment Home Tax Solutions

Dallas Property Tax Loans Dallas Home Tax Solutions

Property Tax Loans Residential Commercial Lender Propel Tax

Should I Clean Out My 401 K To Pay Off My Mortgage Fox Business

Irs Leins 9 Ways To Resolve Tax Leins Irs Tax Lien Help Faith Firm

Taxq Services Corelogic Commercial Tax Formerly Nts

What To Do If You Can T Pay Your Texas Property Taxes Home Tax Solutions

How To Pay Off Your Mortgage Early 5 Of The Best Options To Explore Fox Business

Are Property Tax Loans A Good Idea Home Tax Solutions

Smith S Tax Solutions Inc Home Facebook

What S The Fastest Way To Pay Off Your Mortgage First Citizens Bank

How To Claim The Property Tax Deduction Ramsey

Should I Pay Off My Mortgage Early Busting The Tax Benefit Myth

How Long Should You Keep Papers Home Document Retention Schedule Plus Printable Cheatsheet Paper Clutter Organization Paper Clutter Home Storage Solutions